At each meeting of Hume City Council, members of the public can submit written questions for council staff to answer. Approved questions are answered by council staff who read carefully prepared statements. Here are the questions and answers from Monday 23 September 2024.

Question: I have received my rates and valuation notice for 2024/25 and have the following questions.

What is the percentage rise from last year for, The general rates Kerbside waste charge and public waste charge?

RESPONSE: CHIEF FINANCIAL OFFICER

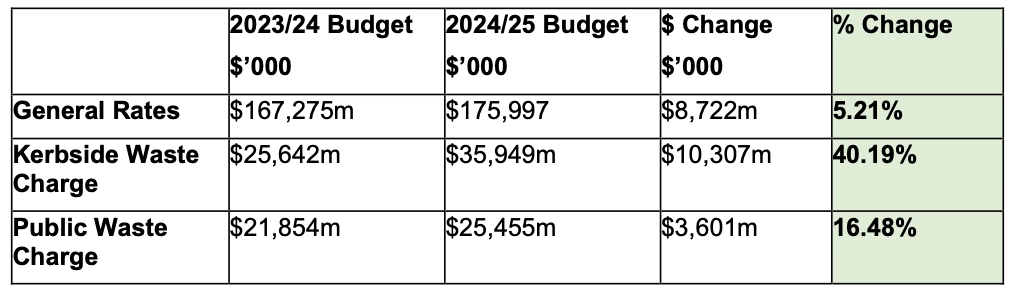

The percentage rise when comparing the 2023/24 Budget to the 2024/25 Budget is as follows:

The 2024/25 Budget is for a 2.75% rate increase across all classes of properties for the 2024/25 year. However, the amount of rates paid by each ratepayer varies as the total rates revenue is apportioned to each rateable property according to the property’s value.

Additionally, the total number of rateable properties grew by over 3,300 from 23/24 to 24/25.

As such, council’s general rates revenue has increased by 5.21% from $167.28 million to $175.99 million, an increase of $8.72 million. The increase above the rate cap is attributed to the growth in property numbers throughout the Financial Year.

All waste charges are cost recovery only, and primarily relate to additional costs associated with the mandated new Recycling Victoria’s Food and Garden Organics (FOGO) service.

It is also important to note that Council’s waste charge is administered on a cost recovery basis only.

Question: Could Council please provide the breakdown of the Conferences and Training expenses for each Councillor between the 1st of October 2020 to 30th June 2024?

REPONSE: CHIEF FINANCIAL OFFICER

Councillors are allocated annual training allowances to support them to attend relevant conferences or to undertake training which supports them in their role with Hume City Council. Expenses incurred for training and conferences are assessed and paid in accordance with the Council Expenses Policy.

Quarterly reports on Councillor expenses are published on Council’s website, in addition to regular reporting to Council’s Audit & Risk Committee.

A breakdown for each Councillor’s conference and training expenses between 1 October 2020 and 30th June 2024 will be provided at the next Council Meeting.

Question: In a recent council meeting (July 22) a question was raised about the costs associated with holding a council meeting virtually with the cost identified as $12.14 per meeting, which was very cost effective. Meetings held in person have significant costs Including all associated travel claims, catering, security, audio visual and room hire costs. My question is, what was the total average cost per council and briefing meeting held in person for the 23/24 budget year?

RESPONSE: CHIEF FINANCIAL OFFICER

Thank you for this question, which was taken on notice at the Council meeting held on 26 August 2024. The total average cost per Council Meeting held in person for 23/24 financial year was $3742.20. This includes average expenses incurred for travel claims, catering, security, and staffing costs.

The total average cost per Council briefing held in person for 23/24 financial year was $3530.20. This includes average expenses incurred for travel claims, catering, security, and staffing costs which are lower than incurred for council meetings. To further public transparency and access to council decision making processes, all Council Meetings are live streamed. This incurred audio visual support costs of $6843.14 on average per meeting.

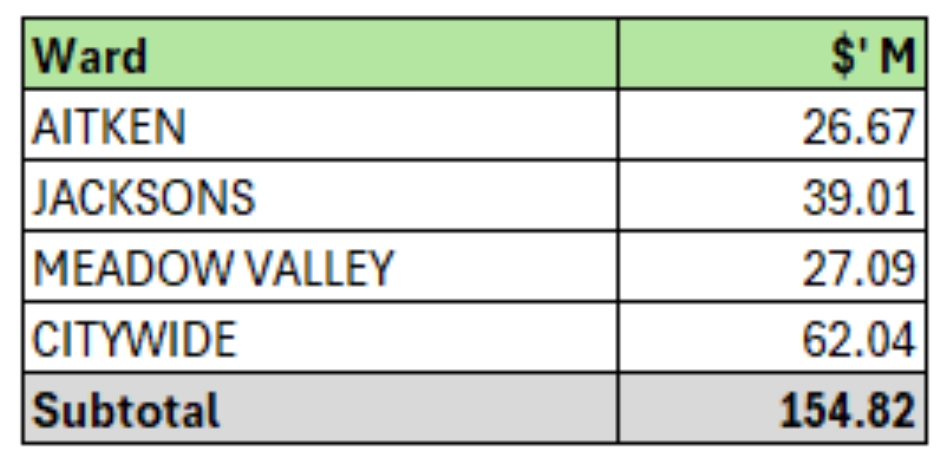

Question: In the Hume City Council 2024/25 budget, what is the capital works spend breakdown by ward?

RESPONSE: CHIEF FINANCIAL OFFICER

Please find 2024/25 budget by ward in the following table.

Question: For this term of Council, how many Notices of Motion has each Councillor submitted?

RESPONSE: CHIEF FINANCIAL OFFICER

Thank you for this question. This question will be taken on notice and a response will be provided at the next Council meeting on 14 October 2024.